Learn about Dex

Hi there! Welcome to Dex, Forte's latest and greatest payments application. With Dex, you can view, create, and manage all your transaction data—including customers, payment methods, addresses, and schedules—in one convenient place. You can also view and maintain your merchant account, keep track of your funding entries, resolve disputed transactions, and generate API credentials to connect Dex with your third-party applications.

Getting Started - Merchants

If you're new here or a pro who just needs a refresher, the following topic provides an overview of Dex account structures, roles and permissions, common Dex terminology, and how to navigate inside the application. Let's get started!

The Dex Vocabulary

Before we get into how to navigate Dex, let's have a quick vocabulary lesson, so we're all on the same page.

Organizations and Locations

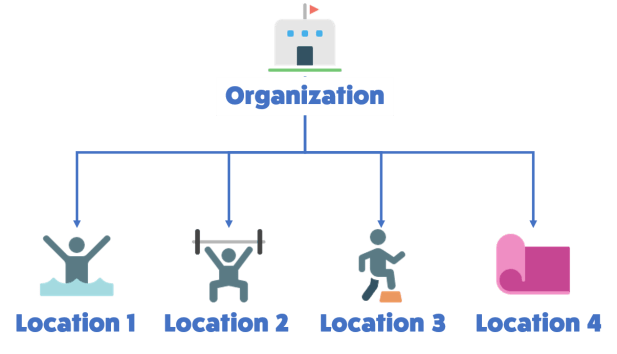

When your company was onboarded into Dex, we gave you an Organization ID and at least one Location ID. In Dex, an Organization is a legal entity that owns the data collected by Locations. A Location is a transaction processing endpoint where you initiate transactions (in Forte legacy systems like Virtual Terminal, Locations were known as MIDs). Let's say you own a gym with multiple sites around a city. The gym is the Organization that owns all the transactions, customer information, and payment method data collected at each site, or Location.

When you log into Dex, you are logging into your Organization. All merchants have at least one Location, however; if you have multiple Locations, the customer, payment method, and address data can be shared across multiple Locations owned by the same Organization.

Roles and Permissions

The menu options that you see in Dex and the actions you can perform depend upon your Role. A Role is a set of permissions that define what a user can and cannot do when he or she is logged into the Organization. For merchant organizations, Dex has five out-of-the box roles with different permissions: User, Manager, Admin, Developer, and View Only. Segmenting these roles in this way ensures that sensitive data is kept secure and that only certain users can perform sensitive actions. For example, in our gym example, our cashiers—with the Users role—will need the ability to create sale transactions; however, we don't want to give them permissions to perform Force transactions as those types of operations require prior authorizations from the card issuer and can create fraud liability for merchants in the form of excessive chargeback losses.

Tokens

A token is a unique, random string of numbers and letters that Forte uses to reference a customer, payment method, or address record in our secure databases. Passing tokens in your transactions instead of customer or payment method data adds an extra layer of security against fraud and data breaches. It also provides a convenient method for your customers to quickly access their information for faster checkouts and recurring payments. All Locations under an Organization share tokens, no matter which Location created the token.

Buttons to Know

Buttons | Name | Description |

Export | Exports up to 10,000 records of the selected datagrid into a .csv file. | |

Refresh | Refreshes the selected datagrid or details screen to display the most up-to-date information about the record. | |

Actions | Gives you the ability to perform specific actions on a record from the datagrid rather than accessing the record's details screen and performing the action (e.g., Void an In-Progress transaction). | |

Items Per Page | Gives you the ability to define how many records display on a datagrid page. Supported options include the following: • 20 items per page | |

Reference | A collection of reference materials, including "Getting Started" instructional videos, the Dex Help docs, links to Forte's Developer Documentation, links to Dex's Release Notes Blog, and a Feedback page where you can submit comments about your Dex experience. | |

Notifications | Gives you the ability to view and subscribe to notifications about transactions, schedules, and disputes. | |

User Profile | The menu you select when you need to update your Dex user profile, switch to Dex sandbox, quickly view the details of your merchant organization, or log out of Dex. | |

Expand Datagrid | Displays additional columns in the selected datagrid. This button is primarily for the Disputes Datagrid, which only displays for merchant that process credit card transactions. | |

Dex Load Bar | Displays when Dex is loading data. Load times can take up to 2 minutes. |

Setting Up Dex

The following steps provide a guide on how to set up Dex for your merchant organization, so that you can begin processing transactions, capturing customers, tracking your funding and so much more. Depending on your setup, you may not need to complete every step listed below. Your Implementation Specialist can walk you through the setup and configuration process.

Step 1: Invite Users

Your Forte Implementation Specialist will send you an admin invite to your Dex account. Once you've registered, you can begin inviting users with different roles to Dex. Users with admin roles will see more menu options in Dex than users with merchant user roles. If you'd like to give certain users permissions that are not part of their out-of-the-box role, you can request a custom role with the needed permissions and add that user to the custom role. And don't worry—you can edit assigned roles or delete roles from user accounts as your business grows and changes.

Step 2: Create API Credentials

If you want to accept card-not-present payments, you have the option to either create your own payment form and connect it to the Forte platform via REST API or SOAP API parameters, or to create and configure the Forte Checkout button and payment modal. Either option requires API credentials to authenticate transactions. Users with Admin or Developer roles can create REST API credentials to use with the following products:

- REST API v3

- Forte Checkout v2

For legacy products like Secure Web Pay and AGI, Admins or Developers can create Legacy credentials to use with the following products:

Step 4: Set Up and Test Your Payment Channels

Offering customers multiple ways to pay is essential for scaling and streamlining your operations. Dex captures your transactions in an elegant, easy-to-use solution, so that you can concentrate on building your business. As an all-in-one solution, Dex gives you the ability to integrate and process ACH and credit card transactions online, in-person, or over the phone. The following table displays these three payment channels and the Forte products you can use to capture transactions. Some products are ready for testing out-of-the box after your Admin works with Forte's Implementation team to set it up; other products need to be set up by either a Merchant Admin or a Developer.

Payment Channel | Product | Merchant Developer Configured | Forte Configured |

Web | |||

BillPayIt/BillPay | |||

Phone | Interactive Voice Response (IVR) | ||

In Person | Dex | ||

Step 5: Set Up and Test Add-On Services

Forte's subscription services can help you maximize your revenue by reducing PCI-compliance expenses and ensuring payments are properly processed. Some services are ready for testing out-of-the box, while others will need to be set up/configured by either a Merchant Admin or a Developer.

Service | Payment Types | Developer Configured? | Admin Configured? | Forte Configured? |

Both | ||||

eCheck Only | ||||

Credit Card Only | ||||

eCheck Only |

Step 6: Create Webhooks

If you are integrating your payments software to the Forte platform using Forte's REST API, you'll want to create webhooks to track your transaction data. Webhooks are postback messages that Forte sends to a unique, server-side URL endpoint that you define. They're a more reliable and secure method of verifying transactions and give your business the ability to quickly fix errors and protect against fraud. For more information on webhooks, see Using Webhooks.

Step 7: Subscribe to Notifications

Keep tabs on transaction, schedule, and dispute events by simply checking your email. By subscribing to notifications, you'll know instantly when an event occurs, so you can act upon it quickly.

Step 8: Start Testing

Once you've set up your payment channel(s) and Dex configuration, you're ready to begin testing. Switch between the Sandbox and Live environments in one click. If you find a bug, always let us know by submitting a ticket. For feedback about Dex or feature requests, drop us a line by selecting Feedback from the Reference menu (i.e,