Reports

Hi there! Welcome to Dex, Forte's latest and greatest payments application. With Dex, you can view, create, and manage all your transaction data—including customers, payment methods, addresses, and schedules—in one convenient place. You can also view and maintain your merchant account, keep track of your funding entries, resolve disputed transactions, and generate API credentials to connect Dex with your third-party applications.

Bill Payments Reports

IVR Report

The Pay By Phone (IVR) report provides information on the calls placed and payments made through Interactive Voice Response (IVR) system, an inbound voice prompts-based payment system.

The data in the report is displayed based on the date selection and the Merchant ID | Merchant name selection. Merchant ID/Merchant Name and Date Range are prominently indicated in the report.

Report Values

The following fields are included in the Summary tab:

Field Name | Description |

Customer’s Phone Number | Customer’s contact information |

Date Call Received | Date (mm/dd/yyyy) when the call was placed to make a payment |

Time Call Received | Time (hh:mm am/pm) when the call was placed to make a payment |

Time Call Ended | Time (hh:mm am/pm) when the call was ended |

Receivable Type Entered | Type of payment to be made.Voice prompts example: 01- Personal Property Tax 02 - Real Estate Tax and so on |

Account Identification Entered | Unique identifier the user enters depending on the Jcode (Jurisdiction code). (Example property id or bill id) |

Last Prompt Selected | The last prompt selected on the keypad before the call was dropped in the process of making payment |

Transaction ID | Transaction ID associated with the payment |

Payment Date | Date when the payment is completed. If no payment has been made it would appear as N/A |

Payment Time | The time when the payment is completed. If no payment has been made it would appear as N/A |

Payment Amount | The amount paid for the transaction provided |

Payment Method | Card/E-check/AMOP(Alternative Method Of Payment) |

Card Type | Whether the payment is through a card or e-check Values:- - C – Credit or debit card - E – E-check |

Payment Status | The phase at which the payment is at Values:

|

Settlement Date | The date and time when the payment was settled with the bank |

Settlement Status | States which phase the payment is currently at Values: • authorized |

Payment Source | The channel through the payment is made. Value

|

Generating a Pay By Phone (IVR) Report

To generate an Excel report:

1. Navigate to the merchant organization level. 2. Click Reports in the left main menu. 3. Click on the PAY BY PHONE (IVR) tab. 4. Click the Date field to choose specific dates for your report. 5. Click the Locations field to select/change the location of the report. 6. Click on the Download Pay by Phone (IVR) Report button

The default for the PAY BY PHONE (IVR) report is 'Last Month'. You can select up to 6 months going back to 2 years.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have an IVR feature enabled. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have logged in to a merchant-level organization.

Text to Pay - SMS Activity Detail and Summary Report

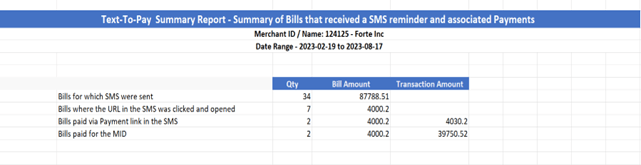

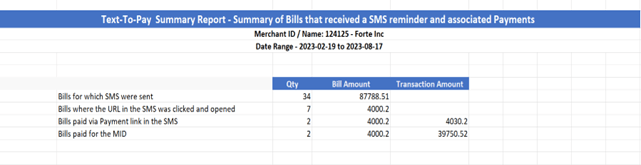

Text to Pay > SMS Activity Detail and Summary report provides information on text reminders that were sent for the bills associated with subscribed Account Ids, along with the record of received payments.

Report information is presented across 2 tabs: “Summary Report” and “Detailed Report”. Data in both tabs depends upon the selected date range and chosen Merchant ID or Merchant Name. In each tab, Merchant ID/Name and date range are prominently indicated.

The value of each row is given in Qty, Bill amount, and Transaction amount.

Qty signifies the quantity or count of bills for which text reminders were sent.

Bill Amount represents the total sum of all the bills that received text reminders.

Transaction Amount denotes the cumulative value of bills that were successfully paid.

Report Values

The following fields are included in the Summary Report tab:

Field Name | Description |

Bills for which SMS were sent | The count of bills for which SMS were sent |

Bills where the URL in the SMS was clicked and opened | The count of bills, out of the total number of bills for which text reminders were sent, where users clicked on the payment link |

Bills paid via payment link in the SMS | The total number of bills present to the customer for which the user clicked and opened the payment link present in the text notification |

Bills paid for the MID | The total count of bills paid by customers across all available payment methods for a particular merchant. |

Detailed Report Tab

The following fields are included in the Detailed Report tab:

Field Name | Description |

Customer Name | Name of the customer |

Phone Number | Customer’s contact information |

Customer ID | Search field for opt-in (unique identifier) |

Unique Bill ID | Unique identifier of the bill present |

Bill Date | The date the bill was presented (It is the presentation date) |

Full SMS sent | The entire message sent to the customer |

SMS Status | It states whether the customer received the SMS or not. This is a Y/N response. Y - Yes, the customer received the message. N- No the customer did not receive the text. |

Sent - Timestamp | Date and time of when the SMS was sent |

Click on URL- Timestamp | Date and time of when the user clicked on the URL.Get the latest date and time. |

Transaction ID | Transaction ID associated with the payment |

Payment Date | Date and Time of when the payment is completed. If the bill has not been paid it would appear N/A |

Payment Amount | Amount paid |

Payment Method | Visa/Master/Card type |

Payment Method Type | Card/E-check/AMOP |

Payment Channel | States how the payment is done. Values: • T2T – Text to Pay |

Payment Status | Whether the payment was completed or failed Values: • A – Accepted |

Generating a Text To Pay Report

To generate an Excel report:

1. Navigate to the merchant organization level.

2. Click Reports, an item on the menu (which is to the left).

3. Click on the TEXT TO PAY tab.

4. Click the Date field to choose specific dates for your report.

5. Click the Locations field to select/change the location of the report.

6. Click on the SMS Activity Detail and Summary button.

The default for the Text to Pay report is 'Last 6 months'. Reports can include up to 366 consecutive data starting up to two years ago.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have the Text to Pay feature enabled.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Text to Pay - Subscription Details Report

SUBSCRIPTION DETAILS REPORT

Text to Pay > Subscription details report provides information on users that have subscribed or unsubscribed to/from the Text-to-Pay service.

Report Values

The dashboard in the report includes the following information.

-

Phone numbers opted in –The phone numbers registered to receive the text notifications.

-

Account IDs opted in – The Account ID(s) subscribed to receive text reminders.

-

Phone numbers opted out - The phone number of the user that unsubscribed from receiving the text notifications.

-

Account IDs opted out - The Account ID(s) of the user that was removed during the opting-out process

The following fields are included in the Summary tab:

Generating a Text-To-Pay Report

To generate an Excel report:

1. Navigate to the merchant organization level.

2. Click Reports on the left of the main menu.

3. Click on the TEXT TO PAY tab.

5. Click the Locations field to select/change the location of the report.

6. Click on the Subscription details (as of today) button.

First time you access the report, location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have the Text to Pay feature enabled.

NOTES:

-

The Reports tab is visible only when you have your home account set to a merchant organization.

-

Date selection is not required/applicable for Subscription details (as of today) report.

Daily Transaction Report

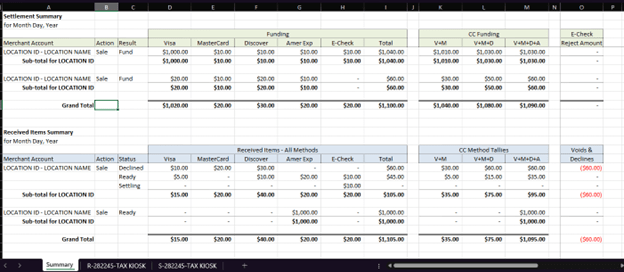

Understanding the Daily Transaction Report

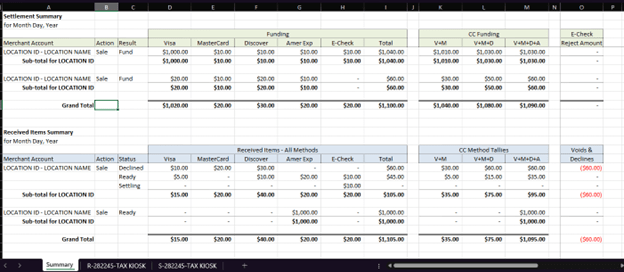

The Daily Transaction report is an .xlsx report that provides Merchants transaction activity with specific payment details for a specified date.

The data in the report is displayed in 2 or more tabs; Summary, Settlement(S) and Received(R) and is based on the date the user selects. Reports can be set up to contain Settled and Received data OR Settled only depending on the Merchant’s preference.

The summary tab is divided into two sections, a settlement summary by location and a received summary by location. The settlement summary displays the dollar value funded by card types and eCheck and includes the eCheck Reject amount. The received summary displays the dollar value of received items and includes the Voids and Declines amount.

The S (Settlement) tab and the R (Received) tab provides the details for each transaction used to calculate the values in the summary tab. One settlement and one received tab is created for each location included in the report.

Report Values

The following fields are included in the Summary tab:

Column | Description |

Merchant account | Display the Merchant Account and name. |

Action | Type of Transaction. E.g., Sale, Credit, Refund etc. |

Result | The result of the transaction. E.g., Decline, Ready, Settling etc. |

Funding Section | Will describe t The Payment method used. |

Visa | The total dollar amount of Visa Card Credit/Debit card transactions. Sale transactions include Sale, Debit, Auth, and Force. |

MasterCard | The total dollar amount of MasterCard Credit/Debit card transactions. Sale transactions include Sale, Debit, Auth, and Force. |

Discover | The total dollar amount of Discover Card Credit/Debit card transactions. Sale transactions include Sale, Debit, Auth, and Force. |

Amer Expr. | The total dollar amount of American Express Credit/Debit card transactions. Sale transactions include Sale, Debit, Auth, and Force. |

E-Check | The total dollar amount of eCheck transactions. Transactions include Debit, Auth, and Force. |

PayPal | The total dollar amount of PayPal transactions. Sale transactions include Sale, Debit, Auth, and Force. |

CC Funding | The total dollar amount of Credit/Debit Card transactions. |

V+M | The total dollar amount of Visa and Mastercard transactions. |

V+M+D | The total dollar amount of Visa, Mastercard and Discover transactions. |

V+M+D+A | The total dollar amount of Visa, Mastercard, Discover and America Express transactions. |

Echeck Reject Amount Voids & Declines | The total dollar amount of echeck transactions rejected. The total dollar amount of echeck transactions voided or declined. |

Daily Transaction Reports are customizable based on your business needs, and can include the following fields in the Settlement and Received tabs:

Column | Description |

Account Code | The accounting code entered for procurement cards |

Account Type | The account type - Checking or Savings account. |

Attempt Number | Number of attempts to execute the transaction |

Authorization Code | Display the Authorization Number |

AVS Method | Address Verification Services method used |

AVS Result | The result of the Address Verification Service check. The following values are supported: Match Partial Match No Match System Unavailable Invalid Not Supported |

Batch Reference Code | The funding entry’s identification number |

BillTo City | The city of the customer's billing address |

BillTo Company Name | The Company of the customer's billing |

BillTo Email Address | The customer's email address |

BillTo FirstName | Customer First Name |

BillTo LastName | Customer Last Name |

BillTo Postal Code | The zip or postal code of the customer's billing address |

BillTo State | The state of the customer's billing address |

BillTo Street Line 1 | The first line of the customer's billing address |

BillTo Street Line 2 | The second line of the customer's billing address |

BillTo Telephone Number | The customer's phone number |

Card Type | Type of the card |

Cardholder Name | The customer's cardholder name |

Check Number | The number of the check. |

Client ID | Customer ID number |

Consumer ID | The Company Name or First and Last Name of the customer associated with this transaction. If applicable, this field also includes the merchant-specified Consumer ID. |

Consumer Order ID | If supplied, the merchant-defined Order Number and Reference ID included with the transaction. These parameters can include anything from invoice IDs, ticket numbers, or P.O. Box numbers. |

Created Date | Transaction create date |

Credit Card Processor | Company that is responsible to process the Credit Card |

Customer Email | The customer's email address |

Customer Fax | The customer's Fax number |

Customer Phone | The customer's Phone number |

CVV Method | Card Verification Value method |

CVV Result | The result of the Card Verification Value check. The following values are supported: Match No Match Error (Unrecognized or Unknown Response) Invalid or Null Not Processed Service Not Supported Issuer Unable to Process No Response |

Debit or Credit | Type of payment for cards |

Entered By | The name or API key of the user that created this transaction. |

Entry Class Code | Code used to identity the NACHA payment type (standard entry class) |

Entry Description | The Entry Description Override value overrides whatever value the merchant originally sends in the Entry Class Code field when submitting the transaction. To set a value for the Entry Description Override field, use the dropdown menu to select the preferred SEC Code. |

File Reference Code | File Reference Code |

Freight Amount | The amount paid to a carrier company for the transportation of goods from the point of origin to an agreed location. |

IP Address | The IP Address from where the merchant/partner submitted the transaction. |

Item Description | A brief description of the schedule or service. |

Last 4 digits | The last four digits of the card or echeck account number. |

Line Items | Detailed descriptions regarding the customer and the transaction, such as: Customer Name,Customer Id,Bill Number,Unique Bill Id,Payment Amount,Late Fee Fixed |

Merchant Data 9 | Customer Define vfileds |

Merchant ID | The Merchant ID number |

Origination Date | The date on which the funds of the transaction go to the originating depository financial institution. |

Preauth Code | Preauth Code Received related to the transaction |

Preauth Description | Preauth Description received related to the transaction |

Preauth Negative Report | Describes why the transaction was declined due to a pre-authorization (Forte Verify) result. |

Preauth Result | The result of the customer pre-authorization |

Proc Card | Procurement Card |

Product | Describe the product |

Response Code | This field displays the response and settlement codes for rejected transactions. • R01 - Insufficient Funds - The balance is not sufficient to cover the value of the transaction. |

Response Description | The transaction response values:

|

Response Type | Preauth Result Type, will be displayed with the following results as example: • A = APPROVED |

SalesTax Amount | Sales tax amount of the transaction |

Service Fee | If applicable, the amount of the service fee for each transaction |

Service Fee Principal | The service/convenience fee for the transaction. Service fees are either a percentage of the principal or a set amount. |

Settle Date | Settlement date for the customer transaction |

Settled Response Code | Settlement Response Code related to the customer transaction. |

ShipTo Address | Shipping Address Line 1 |

ShipTo Address2 | Shipping Address Line 2 |

ShipTo City | Ship To City |

ShipTo Name | Ship To Customer Name |

ShipTo PostalCode | Ship To Postal Code |

ShipTo StateProvince | Ship To State |

Status | The status of the transaction. The following values are supported: • In Progress - The transaction was received and is awaiting origination (echecks) or settlement (credit cards). If authorized, this field also displays the Status, Response, Return, and/or Settlement Code that returned with the response. |

Total Amount | The total authorization amount for each transaction. |

Transaction ID | A 36-character code that uniquely identifies the transaction. |

Transaction Type | Dex supports the following transaction types:

|

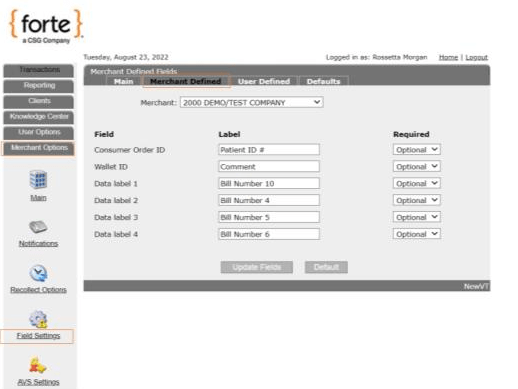

*Data label 1 - User Defined | Merchant custom-defined fields defined in VT |

*Data label 2 - User Defined | Merchant custom-defined fields defined in VT |

*Data label 3 - User Defined | Merchant custom-defined fields defined in VT |

*Data label 4 - User Defined | Merchant custom-defined fields defined in VT |

*Data label 5 - User Defined | Merchant custom-defined fields defined in VT |

*Wallet ID | A merchant-defined description or reference ID related to the transaction. |

*Merchant defined fields are used to configure mandatory and optional fields and their visibility when adding transactions. These fields can be customized in VT under Merchant Options>Field Settings>Merchant Defined tab.

Generating a Daily Transaction Report

To generate a report:

-

Navigate to the merchant organization level.

-

Click Reports in the left main menu.

-

Select the Daily Transaction Report tab.

-

Click the Date field to select a specific date. One day can be selected from the previous 7 days.

-

Click the Select a Report field to select the report by searching on Report Name or Transmitter ID.

-

The download will start immediately if the report is available.

The Date field refers to the date that the report was created. This field defaults to the previous day. Reports can include one day of data from the previous seven days.

The Report Name is the name established at the time the report is set-up and is usually a reference to the merchant name and may include a department name. If the merchant has requested to receive the report via FTP, the TID (Terminal ID) will follow behind the report name.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Payout Reconciliation Report

Understanding the Payout Reconciliation Report

The Payout Reconciliation report provides a summary of transactions that CSG Forte paid out to a merchant's designated bank account during a specific date range. The Reports tab is visible only when you have your home account set to a merchant organization.

The report lists account activities, counts, and amounts.

Report Values

The report lists data in six sections, as specified by the date range you select.

Column | Description |

Account Activity | Identifies the type of transactions included in the total. |

Activity Count | The number of transactions included in the amount. |

Amount | The total dollar amount. |

Section | Description |

Sale | The total dollar amount of funded eCheck and credit card transactions. Sale transactions include Sale, Debit, Auth, and Force. |

eCheck | The total dollar amount of funded eCheck sale transactions. Transactions include Debit, Auth, and Force. |

Card | The total dollar amount of funded credit card sale transactions. Card sale transactions include Sale, Auth, and Force. |

Refund Credits | The total dollar amount of eCheck and credit card refund and credit transactions. |

eCheck | The total dollar amount of eCheck refund and credit transactions. |

Card | The total dollar amount of credit card refund and credit transactions. |

Disputes | The total dollar amount of won and lost dispute transactions. |

Won | The total dollar amount of won dispute transactions. |

Lost | The total dollar amount of lost dispute transactions. |

Reserves | The net dollar amount of reserves withheld. Manual reserves that are held and reserves released manually are not be included in the report. |

Discount Fee | The total amount of discount fees. |

Payout | The total amount deposited to the customer’s bank account. This amount includes the net of all sales, refund credits, disputes, reserves, and discount fees. |

Generating a Payout Reconciliation Report

The Payout Received Date field refers to the date that the funds were deposited to the merchant's designated bank account.

This field defaults to the previous two days. Reports can include up to two years of data, and up to 366 consecutive days of information.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location is selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

To generate a report:

- Navigate to the merchant organization level.

- Click Reports in the left main menu. The Payout Reconciliation report page displays.

- Click the Payout Received Date field to choose specific dates for your report.

- Click the Locations field to change the location of the report.

Virtual Terminal Reports

Convenience Detail Report

Understanding the Service Fee Detail Report

The Service Fee Detail report shows each transaction included in a deposit for a specific date and is available after the transactions have been settled or funded. This report includes any rejected or unfunded transactions included in the deposit as well as convenience fees.

When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report, sometimes it helps to search the report a business day before the date on the bank statement.

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are included in the Detail by Date section:

Column | Description |

Orig Date | Origination date of the transaction |

Customer Information | Bill to First Name Bill to Last Name or Company Name plus Consumer ID Info |

Transaction Info | Data contained in the Consumer Order ID field in Dex |

Entered By | The name or API key of the user that created this transaction |

Batch ID | Settlement Batch ID |

Method | Method Used to create the transaction Valid values are: Credit Card Methods: This parameter displays the logo of the following supported card brands: American Express Discover MasterCard Visa Diners JCB eCheck Methods: Echeck |

Debit Credit | Identifies the transaction as a Debit or Credit D = Debit C = Credit |

Trans Amount | Principal amount of the transaction |

Serv Fee | Service Fee Amount included in the transaction amount |

Amount w/Fees | Total amount of the transaction |

Fund Amount | Amount funded to the merchant |

Trans Amount Total | Total principal amount of the transactions for the time period |

Serv Fee Total | Total amount of the service fees for the transactions for the time period |

Amount w/Fees Total for the date | Total amount of the transactions including service fees for the time period |

Total Fund Amount for the date | Total funded amount of the transactions for the time period |

The following fields are included in the Totals by Time Period section:

Column | Description |

EChecks Debits (Sales) | Total amount of ECheck Sale transactions funded for the time period |

Echecks Credits (Refunds) | Total amount of ECheck Refund transactions funded for the time period |

Echecks Returns | Total amount of ECheck Returns funded for the time period |

Echecks Chargebacks | Total amount of Echeck Chargebacks funded for the time period |

Echecks UnChargebacks | Total amount of ECheck UnChargebacks funded for the time period |

Echecks Net | Net amount of ECheck transactions funded for the time period |

MC/VISA Debits (Sales) | Total amount of MC/VISAs Sale transactions funded for the time period |

MC/VISA Credits (Refunds) | Total amount of MC/VISA Refund transactions funded for the time period |

MC/VISA Returns | Total amount of MC/VISA Returns funded for the time period |

MC/VISA Chargebacks | Total amount of MC/VISA Chargebacks funded for the time period |

MC/VISA UnChargebacks | Total amount of MC/VISA UnChargebacks funded for the time period |

MC/VISA Net | Net amount of MC/VISA transactions funded for the time period |

Amex Debits (Sales) | Total amount of Amex Sale transactions funded for the time period |

Amex Credits (Refunds) | Total amount of Amex Refund transactions funded for the time period |

Amex Returns | Total amount of Amex Returns funded for the time period |

Amex Chargebacks | Total amount of Amex Chargebacks funded for the time period |

Amex UnChargebacks | Total amount of Amex UnChargebacks funded for the time period |

Amex Net | Net amount of Amex transactions funded for the time period |

Discover Debits (Sales) | Total amount of Discover Card Sale transactions funded for the time period |

Discover Credits (Refunds) | Total amount of Discover Card Refund transactions funded for the time period |

Discover Returns | Total amount of Discover Card Returns funded for the time period |

Discover Chargebacks | Total amount of Discover Card Chargebacks funded for the time period |

Discover UnChargebacks | Total amount of Discover Card UnChargebacks funded for the time period |

Discover Net | Net amount of Discover Card transactions funded for the time period |

Other CC Debits (Sales) | Total amount of Other Credit Card Sale transactions funded for the time period |

Other CC Credits (Refunds) | Total amount of Discover Card Refund transactions funded for the time period |

Other CC Returns | Total amount of Other Credit Card Returns funded for the time period |

Other CC Chargebacks | Total amount of Other Credit Card Chargebacks funded for the time period |

Other CC UnChargebacks | Total amount of Other Credit Card UnChargebacks funded for the time period |

Other CC Net Amount | Net amount of Other Credit Card transactions funded for the time period |

Total CC Debits (Sales) | Total amount of Credit Card Sale transactions funded for the time period |

Total CC Credits (Refunds) | Total amount of Credit Card Refund transactions funded for the time period |

Total CC Returns | Total amount of Credit Card Return transactions funded for the time period |

Total CC Chargebacks | Total amount of Credit Card Chargeback transactions funded for the time period |

Total CC UnChargebacks | Total amount of Credit Card Refund transactions funded for the time period |

Total CC Net | Net amount of Credit Card transactions funded for the time period |

The following fields are included in the Overall Summary for the Date Range section:

Column | Description |

EChecks Debits (Sales) | Total amount of ECheck Sale transactions funded for the date range |

Echecks Credits (Refunds) | Total amount of ECheck Refund transactions funded for the date range |

Echecks Returns | Total amount of ECheck Returns funded for the date range |

Echecks Chargebacks | Total amount of Echeck Chargebacks funded for the date range |

Echecks UnChargebacks | Total amount of ECheck UnChargebacks funded for the date range |

Echecks Net | Net amount of ECheck transactions funded for the date range |

MC/VISA Debits (Sales) | Total amount of MC/VISAs Sale transactions funded for the date range |

MC/VISA Credits (Refunds) | Total amount of MC/VISA Refund transactions funded for the date range |

MC/VISA Returns | Total amount of MC/VISA Returns funded for the date range |

MC/VISA Chargebacks | Total amount of MC/VISA Chargebacks funded for the date range |

MC/VISA UnChargebacks | Total amount of MC/VISA UnChargebacks funded for the date range |

MC/VISA Net | Net amount of MC/VISA transactions funded for the date range |

Amex Debits (Sales) | Total amount of Amex Sale transactions funded for the date range |

Amex Credits (Refunds) | Total amount of Amex Refund transactions funded for the date range |

Amex Returns | Total amount of Amex Returns funded for the date range |

Amex Chargebacks | Total amount of Amex Chargebacks funded for the date range |

Amex UnChargebacks | Total amount of Amex UnChargebacks funded for the date range |

Amex Net | Net amount of Amex transactions funded for the date range |

Discover Debits (Sales) | Total amount of Discover Card Sale transactions funded for the date range |

Discover Credits (Refunds) | Total amount of Discover Card Refund transactions funded for the date range |

Discover Returns | Total amount of Discover Card Returns funded for the date range |

Discover Chargebacks | Total amount of Discover Card Chargebacks funded for the date range |

Discover UnChargebacks | Total amount of Discover Card UnChargebacks funded for the date range |

Discover Net | Net amount of Other Credit Card transactions funded for the date range |

Other CC Debits (Sales) | Total amount of Other Credit Card Sale transactions funded for the date range |

Other CC Credits (Refunds) | Total amount of Discover Card Refund transactions funded for the date range |

Other CC Returns | Total amount of Other Credit Card Returns funded for the date range |

Other CC Chargebacks | Total amount of Other Credit Card Chargebacks funded for the date range |

Other CC UnChargebacks | Total amount of Other Credit Card UnChargebacks funded for the date range |

Other CC Net Amount | Net amount of Other Credit Card transactions funded for the date range |

Total CC Debits (Sales) | Total amount of Credit Card Sale transactions funded for the date range |

Total CC Credits (Refunds) | Total amount of Credit Card Refund transactions funded for the date range |

Total CC Returns | Total amount of Credit Card Return transactions funded for the date range |

Total CC Chargebacks | Total amount of Credit Card Chargeback transactions funded for the date range |

Total CC UnChargebacks | Total amount of Credit Card Refund transactions funded for the date range |

Total CC Net | Net amount of Credit Card transactions funded for the date |

Generating a Received Detail Report

To generate a pdf report:

-

Navigate to the merchant organization level.

-

Click Reports in the left main menu.

-

Click on the Virtual Terminal Reports tab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locations field to select the location

-

Click on the Convenience Fee Detail button to download the report

The Date field refers to the date that Forte settled or funded the transactions and includes eCheck and Credit Cards as well as any rejected or unfunded transactions in the deposit. This field defaults to the current date and the previous days date. Reports can include up to 366 consecutive days of data going back two years.

-

NOTE: When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report sometimes it helps to search the report a business day before the date, the merchant sees on their bank statement.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Deposit Detail Report

Understanding the Deposit Detail Report

The Deposit Detail report shows each transaction included in a deposit for a specific date and is available after the transactions have been settled or funded. This report includes any rejected or unfunded transactions included in the deposit as well as convenience fees if applicable.

When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report, sometimes it helps to search the report a business day before the date on the bank statement.

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are available in the Detail by Date section:

Column | Description |

Orig Date | Origination date of the transaction |

Customer Information | Bill to First Name Bill to Last Name or Company Name plus Consumer ID Info |

Entry/Item Description | Entry/Item Description received in the batch file submitted |

Transaction Information | Data contained in the Consumer Order ID field in Dex |

Entered By | The name or API key of the user that created this transaction |

Batch ID | Settlement Batch ID |

Method | Method Used to create the transaction Valid values are: Credit Card Methods: This parameter displays the logo of the following supported card brands: American Express Discover MasterCard Visa Diners JCB eCheck Methods: Echeck |

+ / - | Identifies the transaction as a Debit or Credit D = Debit C = Credit |

PFR | Previously Funded Reject - unfunded transaction N = No, this transaction is not a Previously Funded Reject Y = Yes, this transaction is a previously Funded Reject |

Tran Amount | Transaction Amount |

Fund Amount | Amount of the transaction funded to the merchant |

Totals for Merchant | Total amount funded to the merchants account for the time period |

The following fields are included in the Totals by Date section:

Column | Description |

EChecks Debits (Sales) | Total amount of ECheck Sale transactions funded for the time period |

Echecks Credits (Refunds) | Total amount of ECheck Refund transactions funded for the time period |

Echecks Net | Net amount of eCheck transactions funded for the time period |

PF Rejects Debit (Sales) Amount(Sales) | Total amount of Previously Funded Reject Sale transactions funded for the time period |

PF Rejects Credits (Refunds) Amount | Total amount of Previously Funded Reject Refund transactions funded for the time period |

PF Rejects Net Amount | Net amount of Previously Funded Reject transactions funded for the time period |

MC/VISA Debit (Sales) Amount | Total amount of MC/VISA Sale transactions funded for the time period |

MC/VISA Cards Credits (Refunds) Amount | Total amount of MC/VISA Refund transactions funded for the time period |

MC/VISA Net Amount | Net amount of MC/VISA transactions funded for the time period |

Amex Debit (Sales) Amount | Total amount of Amex Card Sale transactions funded for the time period |

Amex Credits (Refunds) Amount | Total amount of Amex Card Refund transactions funded for the time period |

Amex Net Amount | Net amount of Amex Card transactions funded for the time period |

Discover Debit (Sales) ) Amount | Total amount of Discover Card Sale transactions funded for the time period |

Discover Credits (Refunds) Amount | Total amount of Discover Card Refund transactions funded for the time period |

Discover Net Amount | Net amount of Discover Card transactions funded for the time period |

Other CC Debit (Sales) Amount | Total amount of Other CC Card Sale transactions funded for the time period |

Other CC Credits (Refunds) Amount | Total amount of Other CC Card Refund transactions funded for the time period |

Other CC Net Amount | Net amount of Other CC Card transactions funded for the time period |

Debit Cards Debit (Sales) Amount | Total amount of Debit Card Sale transactions funded for the time period |

Debit Cards Credits (Refunds) Amount | Total amount of Debit Card Refund transactions funded for the time period |

Debit Cards Net Amount | Net amount of Debit Card transactions funded for the time period |

Debits (Sales) Total Funded | Total amount of Sales Debit transactions funded for the time period |

Credits (Refunds) Total Funded | Total amount of Refund Credit transactions funded for the time period |

Total Funded Amount Net | Net amount of the funded transactions for the time period |

The following fields are included in the Overall Summary – Debit (Sales) and Credits (Refunds) section:

Column | Description |

eChecks Debits (Sales) Amount | Total amount of eCheck Sale transactions funded for the date range |

eChecks Credits (Refunds) Amount | Total amount of eCheck Refund transactions funded for the date range |

eChecks Net Amount | Net amount of eCheck transactions funded for the date range |

PF Rejects Debits (Sales) Amount | Total amount of Previously Funded Reject transactions funded for the date range |

PF Rejects Credits (Refunds) Amount | Total amount of Previously Funded Reject transactions funded for the date range |

PF Rejects Net Amount | Net amount of Previously Funded Reject transactions funded for the date range |

MC/VISA Debits (Sales) Amount | Total amount of MC/VISA Sale transactions funded for the date range |

MC/VISA Cards Credits (Refunds) Amount | Total amount of MC/VISA Refund transactions funded for the date range |

MC/VISA Net Amount | Net amount of MC/VISA transactions funded for the date range |

Amex Debits (Sales) Amount | Total amount of Amex Card Sales transactions funded for the date range |

Amex Credits (Refunds) Amount | Total amount of Amex Card Refunds transactions funded for the date range |

Amex Net Amount | Net amount of Amex Card transactions funded for the date range |

Discover Debits (Sales) ) Amount | Total amount of Discover Card Sales transactions funded for the date range |

Discover Credits (Refunds) Amount | Total amount of Discover Card Refunds transactions funded for the date range |

Discover Net Amount | Net amount of Discover Card transactions funded for the date range |

Other CC Debits (Sales) Amount | Total amount of Other CC Card Sales transactions funded for the date range |

Other CC Credits (Refunds) Amount | Total amount of Other CC Card Refunds transactions funded for the date range |

Other CC Net Amount | Net amount of Other CC Card transactions funded for the date range |

Debit Cards Debits (Sales) Amount | Total amount of Debit Cards Card Sales transactions funded for the date range |

Debit Cards Credits (Refunds) Amount | Total amount of Debit Cards Card Refunds transactions funded for the date range |

Debit Cards Net Amount | Net amount of Debit Cards Card transactions funded for the date range |

Debits (Sales) Total Funded | Total amount of Sales Debit transactions funded for the date range |

Credits (Refunds) Total Funded | Total amount of Refund Credit transactions funded for the date range |

Total Funded Amount Net | Net amount funded for the date range |

Generating a Deposit Detail Report

To generate a pdf report:

-

Navigate to the merchant organization level.

-

Click Reports on the left main menu.

-

Click on the Virtual Terminal Reports tab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locations field to select/change the location of the report.

-

Click on the Deposit Detail button.

The Date field refers to the date that Forte settled or funded the transactions and includes eCheck and Credit Cards as well as any rejected or unfunded transactions in the deposit. This field defaults to the current date and the previous days date. Reports can include up to 366 consecutive days of data going back two years.

-

NOTE: When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report sometimes it helps to search the report a business day before the date the merchant sees on their bank statement.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Deposit Summary Report

Understanding the Deposit Summary Report

The Deposit Summary report shows the total dollar amount funded into the merchant’s bank account and is available after the transactions have been settled or funded. The totals include any rejected or unfunded transactions in the deposit as well as convenience fees if applicable.

When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report, sometimes it helps to search the report a business day before the date on the bank statement.

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are included in the Overall Summary by Date section:

Column | Description |

Date | Effective Funding Date Format: MMM DD, YYYY |

eChecks | Total amount deposited for eCheck transactions for the time period |

MC/VISA | Total amount deposited for MC/VISA transactions for the time period |

Amex | Total amount deposited for Amex transactions for the time period |

Discover | Total amount deposited for Discover Card transactions for the time period |

Other CC | Total amount deposited for Other Credit Card transactions for the time period |

Debit Cards | Total amount deposited for Debit Card transactions for the time period |

Total Deposit | Total amount deposited for all transactions for the time period |

Grand Total eChecks | Total amount deposited for eCheck transactions for the time period |

Grand Total MC/VISA | Total amount deposited for MC/VISA transactions for the time period |

Grand Total Amex | Total amount deposited for Amex transactions for the time period |

Grand Total Discover | Total amount deposited for Discover transactions for the time period |

Grand Total Other CC | Total amount deposited for Other Credit Card transactions for the time period |

Grand Total Debit Cards | Total amount deposited for Debit Card transactions for the time period |

Grand Total Deposit | Total amount deposited for all transaction types for the time period |

The following fields are included in the Overall Summary – Debit (Sales) and Credits (Refunds) section:

Column | Description |

eChecks Debits (Sales) Amount | Total amount of eCheck Sale transactions funded for the date range |

eChecks Credits (Refunds) Amount | Total amount of eCheck Refund transactions funded for the date range |

eChecks Net Amount | Net amount of eCheck transactions funded for the date range |

MC/VISA Debits (Sales) Amount | Total amount of MC/VISA Sale transactions funded for the date range |

MC/VISA Cards Credits (Refunds) Amount | Total amount of MC/VISA Refund transactions funded for the date range |

MC/VISA Net Amount | Net amount of MC/VISA transactions funded for the date range |

Amex Debits (Sales) Amount | Total amount of Amex Card Sales transactions funded for the date range |

Amex Credits (Refunds) Amount | Total amount of Amex Card Refunds transactions funded for the date range |

Amex Net Amount | Net amount of Amex Card transactions funded for the date range |

Discover Debits (Sales) ) Amount | Total amount of Discover Card Sales transactions funded for the date range |

Discover Credits (Refunds) Amount | Total amount of Discover Card Refunds transactions funded for the date range |

Discover Net Amount | Net amount of Discover Card transactions funded for the date range |

Other CC Debits (Sales) Amount | Total amount of Other CC Card Sales transactions funded for the date range |

Other CC Credits (Refunds) Amount | Total amount of Other CC Card Refunds transactions funded for the date range |

Other CC Net Amount | Net amount of Other CC Card transactions funded for the date range |

Debit Cards Debits (Sales) Amount | Total amount of Debit Cards Card Sales transactions funded for the date range |

Debit Cards Credits (Refunds) Amount | Total amount of Debit Cards Card Refunds transactions funded for the date range |

Debit Cards Net Amount | Net amount of Debit Cards Card transactions funded for the date range |

Debits (Sales) Total Funded | Total amount of Sales Debit transactions funded for the date range |

Credits (Refunds) Total Funded | Total amount of Refund Credit transactions funded for the date range |

Total Funded Amount Net | Net amount of the funded transactions for the date range |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

Attempt 1 | Transaction funded on the first attempt |

Attempt 2 | Transaction funded on the second attempt |

Attempt 3 | Transaction funded on the third attempt |

Gross Qty - Attempt 1 | Number of eCheck transactions funded on the first attempt for the date range |

Gross Qty - Attempt 2 | Number of eCheck transactions funded on the second attempt for the date range |

Gross Qty - Attempt 3 | Number of eCheck transactions funded on the third attempt for the date range |

Attempted $ - Attempt 1 | Total dollar amount of the eCheck transactions submitted - First Attempt for the date range |

Attempted $ - Attempt 2 | Total dollar amount of the eCheck transactions submitted - Second Attempt for the date range |

Attempted $ - Attempt 3 | Total dollar amount of the eCheck transactions submitted - Third Attempt for the date range |

Qty Funded - Attempt 1 | Total number of submitted eCheck transactions funded from the Gross Quantity submitted - First Attempt for the date range |

Qty Funded - Attempt 2 | Total number of submitted eCheck transactions funded from the Gross number submitted - Second Attempt for the date range |

Qty Funded - Attempt 3 | Total number of submitted eCheck transactions funded from the Gross number submitted - Third Attempt for the date range |

% Cleared - Attempt 1 | Percent of submitted eCheck transactions that cleared on the First Attempt for the date range |

% Cleared - Attempt 2 | Percent of submitted eCheck transactions that cleared on the Second Attempt for the date range |

% Cleared - Attempt 3 | Percent of submitted eCheck transactions that cleared on the Third Attempt for the date range |

Funded Amount - Attempt 1 | Dollar amount funded on the first attempt for submitted eCheck transactions for the date range |

Funded Amount - Attempt 2 | Dollar amount funded on the second attempt for submitted eCheck transactions for the date range |

Funded Amount - Attempt 3 | Dollar amount funded on the third attempt for submitted eCheck transactions for the date range |

Gross Qty - Totals | Total Gross number of submitted eCheck transactions attempted for the date range |

Attempted $ - Totals | Total dollar amount for all submitted eCheck transaction attempted for the date range |

Qty Funded - Totals | Total number of submitted eCheck transactions that were funded for the date range |

% Cleared - Totals | Total percent of the number of resubmitted eCheck transactions that cleared for the date range |

Funded Amount - Totals | Total dollar amount of resubmitted eCheck transactions that were funded for the date range |

Generating a Deposit Summary Report

To generate a pdf report:

-

Navigate to the merchant organization level.

-

Click Reports in the left main menu.

-

Click on the Virtual Terminal Reports tab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locations field to select/change the location of the report.

-

Click on the Deposit Summary button

The Date field refers to the date that Forte settled or funded the transactions and includes eCheck and Credit Cards as well as any rejected or unfunded transactions in the deposit. This field defaults to the current date and the previous days date. Reports can include up to 366 consecutive days of data going back two years.

-

NOTE: When Forte funds a deposit, the merchant sees it the next business day. When pulling the deposit detail report sometimes it helps to search the report a business day before the date, the merchant sees on their bank statement.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Origination Received Detail Expanded Report

The Received Detail Expanded report is reflective of all the transactions, eCheck and Credit Cards, that Forte received from the merchant, including declines.

The report Includes:

-

A list of all transactions (CC and eCheck (ACH)) received from the merchant (approvals and declines)

-

Timestamp, User, Routing Number and Last four of the account number

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are included in the Detail by Date section:

Column | Description |

Received | The time the transaction was received Presented as HH:MM AM/PM |

Customer Name | The first and last name of the customer or the company name associated with the customer |

Card Holder Name | The first and last name of the cardholder |

Transaction Info | Information from the Consumer Order ID field |

Trans Type | Action the transaction performs | Method used to perform the transaction Supported options include the following: Credit Card Actions: the action the transaction performs. Supported options include the following: Debit/Sale Refund/Credit Auth Force/External Auth Balance Inquiry Credit Card Methods: American Express Discover MasterCard Visa Diners JCB ACH (eCheck) Actions: The action the transaction performs. Supported options include the following: Debit/Sale Refund/Credit Auth Force Verify ACH (eCheck) Methods: ACH Debit ACH Credit |

Routing Number | The TRN or routing number of the bank. This value is typically the first number listed at the bottom of the check. |

Last 4 | Last 4The last four digits of the customer's credit card PAN. |

CC Exp | The year and month when the credit card expires in yyyy/mm format. |

Auth | The numeric authorization code generated for the transaction (e.g., 244234). |

Status | Credit Card Transactions The status of the transaction's authorization. Supported values include the following: Authorized - The customer's payment was authorized. To complete the sale, the item must be captured from the Transaction's Details page. Declined - The transaction was declined for reasons detailed in the Response Code and Response Description fields. Ready - The transaction was received and is awaiting settlement. Review - Transaction was unable to be settled due to a merchant configuration issue. Contact Customer Service to resolve the issue. Settled - The credit card item has been funded to the merchant's bank account. Voided - The transaction was voided and the item will not be originated or settled. Unfunded - For debit transactions, funds have been removed from the merchant's bank account because of sale transaction returns or dispute losses. For credit transactions, funds have added to the merchant's bank account because of refund dispute losses and refund transaction returns. ACH (eCheck) Transactions: The status of the transaction's authorization. Supported values include the following: Authorized - The customer's payment was authorized. To complete the sale, the item must be captured from the Transaction's Details page. Complete - eCheck verification was performed and the results were positive (POS) or unknown (UNK). Declined - The transaction was declined for reasons detailed in the Response Code and Response Description parameters. Failed - An echeck verification was performed via Validate/Validate+ and the results were negative (NEG) or the transaction failed for reasons detailed in the Response Code and Response Description. Funded - The echeck item was funded to or from the merchant's bank account. Ready - The transaction was received and is awaiting settlement. Review - Transaction was unable to be settled due to a merchant configuration issue. Contact Customer Service to resolve the issue. Settle - The echeck item has been funded to the merchant's bank account. Unfunded - A previously funded echeck item has been returned and funding was reversed. Voided - The transaction was voided and the item will not be originated or settled. |

Amount | The amount of the transaction received |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

eChecks Sales (Debits) Amount | Total amount of eCheck Sale transactions received for the time period |

eChecks Refunds (Credits) Amount | Total amount of eCheck Refund transactions received for the time period |

eChecks Net Amount | Net amount of eCheck transactions received for the time period |

eChecks Sales (Debits) Qty | Total number of eCheck Sales transactions received for the time period |

eChecks Refunds (Credits) Qty | Total number of eCheck Refunds transactions received for the time period |

eChecks Net Qty | Total number of eCheck transactions received for the time period |

MAST Sales (Debits) Amount | Total amount of Mastercard Sale transactions received for the date |

MAST Cards Refunds (Credits) Amount | Total amount of Mastercard Refund transactions received for the date |

MAST Net Amount | Net amount of Mastercard transactions received for the date |

MAST Sales (Debits) Qty | Total number of Mastercard Sale transactions received for the date |

MAST Refunds (Credits) Qty | Total number of Mastercard Refund transactions received for the date |

MAST Net Qty | Total number of Mastercard transactions received for the date |

Visa Sales (Debits) Amount | Total amount of Visa Card Sale transactions received for the date |

Visa Refunds (Credits) Amount | Total amount of Visa Card Refund transactions received for the date |

Visa Net Amount | Net amount of Visa Card transactions received for the date |

Visa Sales (Debits) Qty | Total number of Visa Card Sales transactions received for the date |

Visa Refunds (Credits) Qty | Total number of Visa Card Refund transactions received for the date |

Visa Net Qty | Total number of Visa Card transactions received for the date |

Amex Sales (Debits) Amount | Total amount of Amex Card Sale transactions received for the date |

Amex Refunds (Credits) Amount | Total amount of Amex Card Refund transactions received for the date |

Amex Net Amount | Net amount of Amex Card transactions received for the date |

Amex Sales (Debits) Qty | Total number of Amex Card Sale transactions received for the date |

Amex Refunds (Credits) Qty | Total number of Amex Card Refund transactions received for the date |

AmEx Net Qty | Total number of Amex Card transactions received for the date |

Disc Sales (Debits) Amount | Total amount of Discover Card Sale transactions received for the date |

Disc Refunds (Credits) Amount | Total amount of Discover Card Refund transactions received for the date |

Disc Net Amount | Net amount of Discover Card transactions received for the date |

Disc Sales (Debits) Qty | Total number of Discover Card Sale transactions received for the date |

Disc Refunds (Credits) Qty | Total number of Discover Card Refund transactions received for the date |

Disc Net Qty | Total number of Discover Card transactions received for the date |

Sales (Debits) Total Amount | Total amount of Sales transactions received for the time period |

Refunds (Credits) Total Amount | Total amount of Refund transactions received for the time period |

Total Amount Net | Net amount of the Total transactions received for the time period |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

eChecks Sales (Debits) Amount | Total amount of eCheck Sale transactions received for the date range |

eChecks Refunds (Credits) Amount | Total amount of eCheck Refund transactions received for the date range |

eChecks Net Amount | Net amount of eCheck transactions received for the date range |

eChecks Sales (Debits) Qty | Total number of eCheck Sales transactions received for the date range |

eChecks Refunds (Credits) Qty | Total number of eCheck Refunds transactions received for the date range |

eChecks Net Qty | Total number of eCheck transactions received for the date range |

MAST Sales (Debits) Amount | Total amount of Mastercard Sale transactions received for the date range |

MAST Cards Refunds (Credits) Amount | Total amount of Mastercard Refund transactions received for the date range |

MAST Net Amount | Net amount of Mastercard transactions received for the date range |

MAST Sales (Debits) Qty | Total number of Mastercard Sale transactions received for the date range |

MAST Refunds (Credits) Qty | Total number of Mastercard Refund transactions received for the date range |

MAST Net Qty | Total number of Mastercard transactions received for the date range |

Visa Sales (Debits) Amount | Total amount of Visa Card Sale transactions received for the date range |

Visa Refunds (Credits) Amount | Total amount of Visa Card Refund transactions received for the date range |

Visa Net Amount | Net amount of Visa Card transactions received for the date range |

Visa Sales (Debits) Qty | Total number of Visa Card Sales transactions received for the date range |

Visa Refunds (Credits) Qty | Total number of Visa Card Refund transactions received for the date range |

Visa Net Qty | Total number of Visa Card transactions received for the date range |

Amex Sales (Debits) Amount | Total amount of Amex Card Sale transactions received for the date range |

Amex Refunds (Credits) Amount | Total amount of Amex Card Refund transactions received for the date range |

Amex Net Amount | Net amount of Amex Card transactions received for the date range |

Amex Sales (Debits) Qty | Total number of Amex Card Sale transactions received for the date range |

Amex Refunds (Credits) Qty | Total number of Amex Card Refund transactions received for the date range |

AmEx Net Qty | Total number of Amex Card transactions received for the date range |

Disc Sales (Debits) Amount | Total amount of Discover Card Sale transactions received for the date range |

Disc Refunds (Credits) Amount | Total amount of Discover Card Refund transactions received for the date range |

Disc Net Amount | Net amount of Discover Card transactions received for the date range |

Disc Sales (Debits) Qty | Total number of Discover Card Sale transactions received for the date range |

Disc Refunds (Credits) Qty | Total number of Discover Card Refund transactions received for the date range |

Disc Net Qty | Total number of Discover Card transactions received for the date range |

Sales (Debits) Total Amount | Total amount of Sale/Debit transactions received for the date range |

Refunds (Credits) Total Amount | Total amount of Refund/Credit transactions received for the date range |

Total Amount Net | Net amount of the Total transactions received for the date range |

Generating a Received Detail Expanded Report

To generate the pdf report:

-

Navigate to the merchant organization level.

-

Click Reports in the left main menu.

-

Click on the Virtual Terminal Reports tab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locations field to select/change the location of the report.

-

Click on the Origination Received Detail Expanded button.

The Date field refers to the date that Forte received the transactions from the merchant whether ACH or CC, including declines.

This field defaults to the current date and the previous days date. Reports can include up to 366 consecutive days of data going back two years.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Origination Received Detail Report

The Received Detail report is reflective of all the transactions, eCheck and Credit Cards, that Forte received from the merchant, including declines.

The report Includes:

-

A list of all transactions (CC and eCheck (ACH)) received from the merchant (approvals and declines)

-

A Summary of the transactions received

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are included in the Detail by Date section:

Column | Description |

Received | The time the transaction was received Presented as HH:MM AM/PM |

Customer Name | The first and last name of the customer or the company name associated with the customer |

Transaction Info | Information from the Consumer Order ID field |

Entered By | The name or API key of the user that created this transaction |

Trans Type | Action the transaction performs | Method used to perform the transactionSupported options include the following: Credit Card Actions: the action the transaction performs. Supported options include the following: Debit/Sale Refund/Credit Auth Force/External Auth Balance Inquiry Credit Card Methods: American Express Discover MasterCard Visa Diners JCB ACH (eCheck) Actions: The action the transaction performs. Supported options include the following: Debit/Sale Refund/Credit Auth Force Verify ACH (eCheck) Methods: ACH Debit ACH Credit |

Attempt | The number of times Forte has attempted to collect the funds for this transaction |

Response Code Approval and Declines | The three digit response code returned with the transaction. For a list of transaction response codes, see Transaction Codes in Forte's Developer Documentation |

Response Description | The description that corresponds to the response code returned with the transaction. For a list of transaction response code descriptions, see Transaction Code Descriptions in Forte's Developer Documentation. |

Status | Credit Card Transactions The status of the transaction's authorization. Supported values include the following: Authorized - The customer's payment was authorized. To complete the sale, the item must be captured from the Transaction's Details page. Declined - The transaction was declined for reasons detailed in the Response Code and Response Description fields. Ready - The transaction was received and is awaiting settlement. Review - Transaction was unable to be settled due to a merchant configuration issue. Contact Customer Service to resolve the issue. Settled - The credit card item has been funded to the merchant's bank account. Voided - The transaction was voided and the item will not be originated or settled. Unfunded - For debit transactions, funds have been removed from the merchant's bank account because of sale transaction returns or dispute losses. For credit transactions, funds have added to the merchant's bank account because of refund dispute losses and refund transaction returns. ACH (eCheck) Transactions: The status of the transaction's authorization. Supported values include the following: Authorized - The customer's payment was authorized. To complete the sale, the item must be captured from the Transaction's Details page. Complete - eCheck verification was performed and the results were positive (POS) or unknown (UNK). Declined - The transaction was declined for reasons detailed in the Response Code and Response Description parameters. Failed - An echeck verification was performed via Validate/Validate+ and the results were negative (NEG) or the transaction failed for reasons detailed in the Response Code and Response Description. Funded - The echeck item was funded to or from the merchant's bank account. Ready - The transaction was received and is awaiting settlement. Review - Transaction was unable to be settled due to a merchant configuration issue. Contact Customer Service to resolve the issue. Settle - The echeck item has been funded to the merchant's bank account. Unfunded - A previously funded echeck item has been returned and funding was reversed. Voided - The transaction was voided and the item will not be originated or settled. |

Amount | The amount of the transaction received |

Total For Merchant | Total amount of the transactions received for the date |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

eChecks Sales (Debits) Amount | Total amount of eCheck Sale transactions received for the time period |

eChecks Refunds (Credits) Amount | Total amount of eCheck Refund transactions received for the time period |

eChecks Net Amount | Net amount of eCheck transactions received for the time period |

eChecks Sales (Debits) Qty | Total number of eCheck Sales transactions received for the time period |

eChecks Refunds (Credits) Qty | Total number of eCheck Refunds transactions received for the time period |

eChecks Net Qty | Total number of eCheck transactions received for the time period |

Credit Cards Sales (Debits) Amount | Total amount of Credit Cards Sale transactions received for the time period |

Credit Cards Refunds (Credits) Amount | Total amount of Credit Cards Refund transactions received for the time period |

Credit Cards Net Amount | Net amount of Credit Card transactions received for the time period |

Credit Cards Sales (Debits) Qty | Total number of Credit Card Sale transactions received for the time period |

Credit Cards Refunds (Credits) Qty | Total number of Credit Card Refund transactions received for the time period |

Credit Cards Net Qty | Total number of Credit Card transactions received for the time period |

Debit Cards Sales (Debits) Amount | Total amount of Debit Card Sale transactions received for the time period |

Debit Cards Refunds (Credits) Amount | Total amount of Debit Card Refund transactions received for the time period |

Debit Cards Net Amount | Net amount of Debit Card transactions received for the time period |

Debit Cards Sales (Debits) Qty | Total number of Debit Card Sales transactions received for the time period |

Debit Cards Refunds (Credits) Qty | Total number of Debit Card Refunds transactions received for the time period |

Debit Cards Net Qty | Total number of Debit Card transactions received for the time period |

Sales (Debits) Total Amount | Total amount of Sales transactions received for the time period |

Refunds (Credits) Total Amount | Total amount of Refund transactions received for the time period |

Total Amount Net | Net amount of the Total transactions received for the time period |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

eChecks Sales (Debits) Amount | Total amount of eCheck Sale transactions received for the date range |

eChecks Refunds (Credits) Amount | Total amount of eCheck Refund transactions received for the date range |

eChecks Net Amount | Net amount of eCheck transactions received for the date range |

eChecks Sales (Debits) Qty | Total number of eCheck Sales transactions received for the date range |

eChecks Refunds (Credits) Qty | Total number of eCheck Refunds transactions received for the date range |

eChecks Net Qty | Total number of eCheck transactions received for the date range |

Credit Cards Sales (Debits) Amount | Total amount of Credit Card Sale transactions received for the date range |

Credit Cards Refunds (Credits) Amount | Total amount of Credit Cards Refund transactions received for the date range |

Credit Cards Net Amount | Net amount of Credit Card transactions received for the date range |

Credit Cards Sales (Debits) Qty | Total number of Credit Card Sale transactions received for the date range |

Credit Cards Refunds (Credits) Qty | Total number of Credit Card Refund transactions received for the date range |

Credit Cards Net Qty | Net number of Credit Card transactions received for the date range |

Debit Cards Sales (Debits) Amount | Total amount of Debit Card Sales transactions received for the date range |

Debit Cards Refunds (Credits) Amount | Total amount of Debit Card Refunds transactions received for the date range |

Debit Cards Net Amount | Net amount of Debit Card transactions received for the date range |

Debit Cards Sales (Debits) Qty | Total number of Debit Card Sales transactions received for the date range |

Debit Cards Refunds (Credits) Qty | Total number of Debit Card Refunds transactions received for the date range |

Debit Cards Net QTY | Net number of Debit Card transactions received for the date range |

Sales (Debits) Total Amount | Total amount of Sales Debits transactions received for the date range |

Refunds (Credits) Total Amount | Total amount of Refund Credits transactions received for the date range |

Total Amount Net | Net amount of the Total transactions received for the date range |

Generating a Received Detail Report

To generate the pdf report:

-

Navigate to the merchant organization level.

-

Click Reports in the left main menu.

-

Click on the Virtual Terminal Reports tab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locations field to select/change the location of the report.

-

Click on the Origination Received Detail button.

The Date field refers to the date that Forte received the transactions from the merchant whether ACH or CC, including declines.

This field defaults to the current date and the previous days date. Reports can include up to 366 consecutive days of data going back two years.

The first time you access the report, the location defaults to the first one in the Locations list. After this initial access, the Locations field defaults to the last location you selected. The list includes all locations within the merchant organization that have a status of live, on hold, deleted, or closed. Only one location can be selected per report.

NOTE: The Reports tab is visible only when you have your home account set to a merchant organization.

Return Detail Report

Understanding the Return Item Detail Report

The Return Item Detail report lists any transaction included in the returns that have been rejected or unfunded from the bank for ACH transactions only.

An ACH chargeback is a return. What determines a chargeback is the R code used on the return. ACH Chargebacks, this information is on the returns report listed with all the returns. The chargebacks will be R05, R07, R10 and R29 declines.

The Reports tab is visible only when you have your home account set to a merchant organization.

Report Values

The following fields are included in the Details by Return Code section for the time period:

Column | Description |

Orig Date | Origination date of the transaction |

Customer Information | Bill to First Name Bill to Last Name or Company Name plus Consumer ID Info |

Entry Item/Description | Entry Item/Description received in the batch file submitted |

Transaction Information | Data contained in the Consumer Order ID field in dex |

Method | Method Used to create the transaction eCheck Method: EFT |

Debit Credit | Debit or Credit D = Debit C = Credit |

# | Number of attempts to submit the transaction |

Tran Amount | Transaction Amount |

Fund Amount | Amount of the transaction funded to the merchant |

Totals for Merchant | Total amount of the transactions funded to the merchant for the time period |

Total for Return Code | Total amount of the transactions funded to the merchant for the Return Code and time period |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

Type | Return Code for the transaction(s):Values are: C00 - Credit Card Chargeback R01 - Insufficient Funds R02 - Account Closed R03 - No Account R04 - Invalid Account Number R07 - Auth Revoked R08 - Payment Stopped R10 - Customer not Authorized R24 - Duplicate Entry R29 - Corporate Not Authorized R* - Other U00 - Credit Card Unchargeback |

Quantity Total | Total number of Returns for the return type (return code) and the time period |

Amount Total | Total dollar amount of the returns for the return type (return Code) and the time period |

Funded Amount | Total funded amount of the returns for the return type (return code) and time period |

% of Rejects | Percentage of return items that were rejects for the time period |

Description | Return Code (Type) description:Values are: C00 - Credit Card Chargeback R01 - Insufficient Funds R02 - Account Closed R03 - No Account R04 - Invalid Account Number R07 - Auth Revoked R08 - Payment Stopped R10 - Customer not Authorized R24 - Duplicate Entry R29 - Corporate Not Authorized R* - Other U00 - Credit Card Unchargeback |

Quantity Total | Total number of return items for the time period |

Amount Total | Total amount of the return items for the time period |

Funded Amount Total | Total funded amount of the returns for the time period |

The following fields are included in the Overall Summary – Resubmitted eChecks section:

Column | Description |

Type | Return Code for the transaction(s):Values are: C00 - Credit Card Chargeback R01 - Insufficient Funds R02 - Account Closed R03 - No Account R04 - Invalid Account Number R07 - Auth Revoked R08 - Payment Stopped R10 - Customer not Authorized R24 - Duplicate Entry R29 - Corporate Not Authorized R* - Other U00 - Credit Card Unchargeback |

Quantity | Number of Returns for the return type (return code) and the date range |

Amount | Total dollar amount of the returns for the return type (return Code) and the date range |

Funded Amount | Total funded amount of the returns for for the return type (return code) and the date range |

% of Rejects | Percentage of return items that were rejects for the date range |

Description | Return Code (Type) description:Values are: C00 - Credit Card Chargeback R01 - Insufficient Funds R02 - Account Closed R03 - No Account R04 - Invalid Account Number R07 - Auth Revoked R08 - Payment Stopped R10 - Customer not Authorized R24 - Duplicate Entry R29 - Corporate Not Authorized R* - Other U00 - Credit Card Unchargeback |

Quantity Total | Total number of return items for the date range |

Amount Total | Total amount of return items for the date range |

Funded Amount Total | Total funded amount of the returns for the date range |

Generating a Return Item Detail Report

To generate a pdf report:

-

Navigate to the merchant organization level.

-

Click Reportsin the left main menu.

-

Click on the Virtual Terminal Reportstab.

-

Click the Date field to choose specific dates for your report.

-

Click the Locationsfield to select/change the location of the report.

-

Click on the Return Detail button